The 2026 Outlook Report [Register your interest]

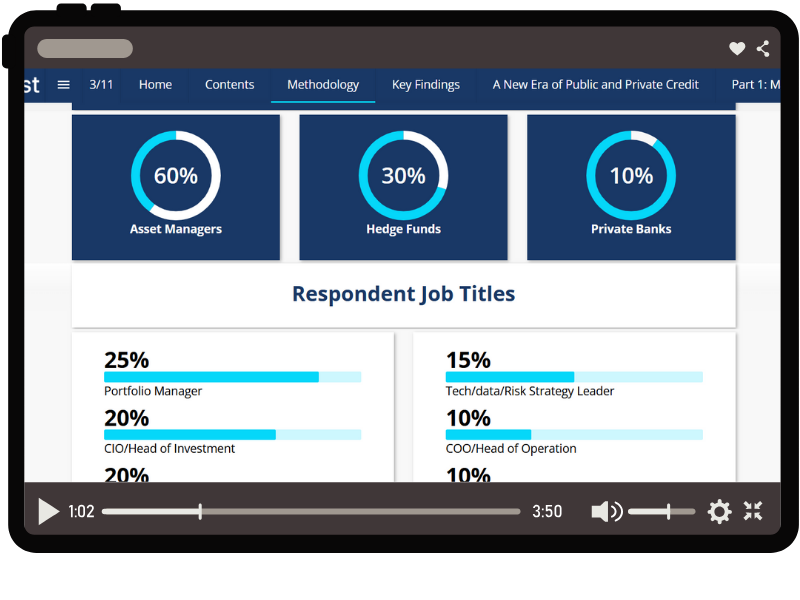

We surveyed 100 senior buy-side professionals across Europe and the United States. Respondents included Portfolio Managers, CIOs/Heads of Investment, and Heads of Private Credit/Direct Lending, representing a broad mix of asset managers, hedge funds and private banks.

Collectively, they reflect the strategic and operational viewpoints of those shaping credit portfolios in the world’s largest markets.

The survey focused on three areas:

- Market Outlook & Convergence: How macro dynamics, geopolitical risk and structural shifts are influencing investment priorities, and how firms are blending public and private credit strategies.

- Liquidity, Portfolio Design & Technology: How managers are balancing illiquidity premix with flexibility, and the technologies enabling more integrated, data-driven credit platforms.

- ESG, Regulation & the Future of Credit: How ESG is being embedded into investment processes and which regulatory developments are expected to shape product design, liquidity management and portfolio construction.

Register your interest now and receive a copy as soon as the report is live!